For years, I've carefully filed all my ATM and bank receipts, so that at the end of every month I can reconcile them with my bank statement. I go through and check everything off in the checkbook to indicate that it's cleared and then balance the remainder of the transactions to be sure the bank and I agree how much money I really have.

Recently, though, I thought about how absurdly antiquated the process is. It was designed for a time when bank statements came monthly in the mail. Nowadays I can hop online and check the status of my account at any time. I can make sure my checks and ATM transactions clear correctly in a matter of days, and there's much less ambiguity about outstanding transactions. (Especially now that I write far fewer checks, preferring to use electronic fund transfers.)

I tried to abandon the practice. I just logged on and checked my account every now and then, to make sure everything looked kosher.

But I never got past the uneasy feeling that I didn't know exactly how much money I had. There were always a few things outstanding that weren't yet shown online. And what if the same ATM charged me twice within a period of a few days -- would I even notice? I felt a little careless, a little sloppy.

So today I sat down and entered three months' worth of transactions in my check register, and I'm going back to my old system. It seems silly to work with so much paper, but old habits die hard. How do you all manage your checkbooks? Do you balance them or just keep an eye on the account directly?

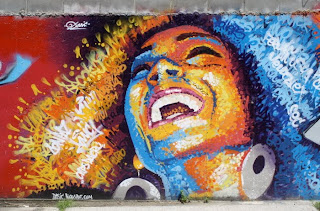

(Photo: Art by Dasic in Bushwick, Brooklyn.)

i am very leery of electronic tranfers and like the routine and habit of managing my checking account by hand - i am so old fashioned i also rarely use a calculator and prefer to do my arithmetic with pen and pencil - like a carpenter with cutting a piece of wood, i always check my sums twice to make sure they are correct.

ReplyDeletei also have a habit of always having what i call my 'shadow money' just in case something doesn't get written down or there is some weird mystery fee that comes along....when i was a young person i experienced the shock of having an fee for bouncing a check and i want to make sure that never happens again!!

great wall....brooklyn you say!!

We use Quicken - & try to do everything electronically. I go on a few times a month to do a sort of reconciliation between Quicken & the online account. I do shred all my receipts after I've entered them in Quicken.

ReplyDeleteI'm impressed with Mouse - I have an accounting degree & yet have a hard time doing the simplest sums in my head. And I am TOO LAZY to do them by hand LOL.

I've used Quicken for years. It works just like a paper checkbook register, but it's on your computer so you can easily generate reports income/expense reports for your categorized expenses. This makes it easy to see how much you spent on X over the course of a month, year, or whatever, which comes in handy at tax time or anytime you want to revisit your budget.

ReplyDeleteI balance accounts when I get my bank & credit card statements, but I also check these online every week or so. This way, I always know how much I'm spending or how much is in my account, and I'll notice any errant charges. (To their credit, American Express quickly identified the one time one of my credit cards was compromised: they caught it before I even saw the charges.)

Regardless of how you keep track of things, I think it's important to do it. Otherwise, it's easy to overspend without realizing it. I'm never "surprised" by my credit card statements because I track them so closely, and that makes it easier to keep my spending in check. ("Oh, I shouldn't splurge on X this week because I bought Y last week," etc.)

I do it the olde fashioned way also.

ReplyDeleteI do not manage my checkbook, nor do I trust electronic transfers. I'm old school hippie, I guess.

ReplyDeleteI don't balance checkbooks. I abandoned the practice when I had my second child, and I was so busy something had to give.

ReplyDeleteNowadays, I just go online and check my record there, and if something doesn't match up, I call customer service immediately, night or day.

I have always balanced my checkbook to the penny every month when the statement came in the mail. I find it agonizing when it occasionally doesn't initially balance. I can't imagine doing it any other way. My bank recently asked if I would like to drop getting a monthly statement and I said no.

ReplyDeletei used to spend a chunk of time reconciling my paper register with the online info (or the paper statement), but i finally gave up after repeatedly having to enter in months and months of information at a time.

ReplyDeleteI use Mint and my online account info to keep a ballpark figure and make any mental adjustments on the running balance for the lag time between real life and the internet. It's not perfect and it never "balances" but it's efficient.

I keep a balanced checkbook with a record of all transactions logged to the day. I take the checkbook with me to the ATM and log my cash withdrawals right when I make them. I regularly check my checkbook records against my online records.

ReplyDeleteNanny Nanny BooBoo!

When did you become more 'reckless' than me when it comes to money!? What's next?...Stigmata!??!

Steve, I use Quicken and online banking. I download my data to Quicken every day or two and I can instantly see if I'm in balance or not.

ReplyDeleteI haven't had a check register, except Quicken in years.

One of the advantages to being a po' white child is there's just not that much to manage. I keep a set figure in my checking account, in case the shit hits the fan, and I never let it drop below. Any money I have above that is fair game, and I keep a running balance in my head of what's what. Once a week, usually Monday, I take a look at the bills that are due for the next week and I pay them. Simple.

ReplyDelete